pa local tax due dates 2021

2021 Personal Income Tax Forms. The local earned income tax filing deadline is accordingly extended to match the State and Federal date of May 17 2021.

Pennsylvania Department Of Revenue Facebook

Description Start Date End Date Due Date.

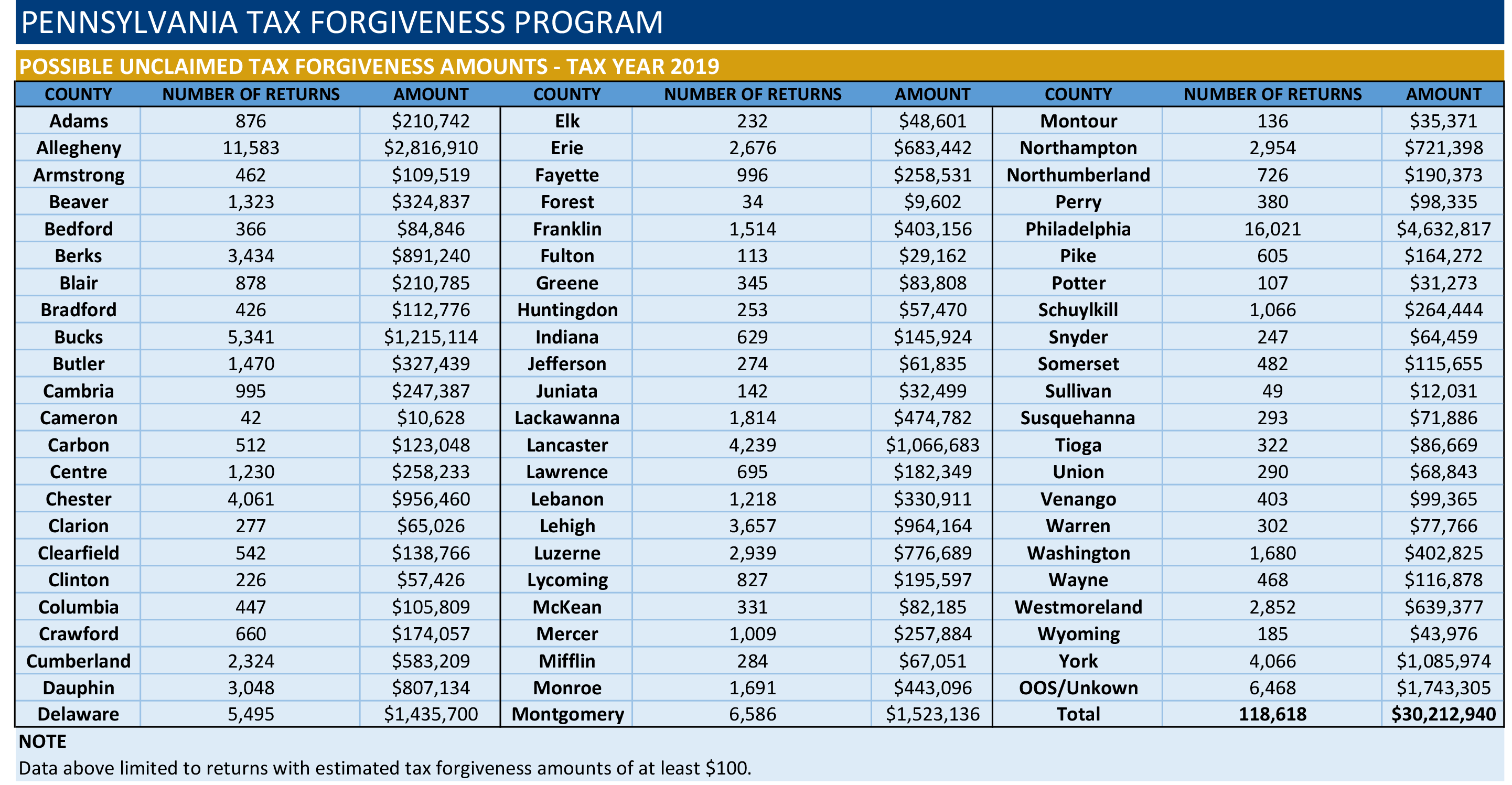

. 16 Current years quarterly estimated payment for Mutual Thrifts for tax years ending Feb. TAX FORGIVENESS Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program. Exact due dates for 2022 Wage Tax filings and payments.

Keystone Collections said today The Local Earned Income Tax filing deadline has NOT been extended beyond the April 15 2021 due date. Pay all of the estimated tax by Jan. Employer Withholding Tax Annual.

18 December 2021 Cigarette Stamping Agent CSA Stamp Payment. Interest after April 15. 2022 weekly Wage Tax due dates January to March PDF.

11 rows BLAIR TAX COLLECTION DISTRICT. In addition the deadline for filing local tax returns and making local income tax payments may still be today April 15 2021. 2nd Quarter - June 15th.

To remain consistent with the federal tax due date the due date for filing 2021 Pennsylvania tax returns will be on or before midnight Monday April 18 2022. The 2021 local earned income tax filing due date is April 18th 2022. LS-1 Local Services Tax 12 December January 31.

To request an extension of. Description Start Date End Date Due Date. Employer Withholding Tax Semi-Weekly.

UF-1 Non-Resident Sports Facility Fee 4. 53 rows Federal income taxes for tax year 2021 are due April 18 2022. Quarterly filings and remittances are due within 30 days after the end of each calendar quarter.

The Internal Revenue Service also. EARNED INCOME TAX BALANCE DUE Line 9 minus Line 13. Start Date End Date Due Date.

1st Quarter - April 15th. Description Start Date End Date Due Date. E-Tides Tax Due Dates.

Harrisburg PA The Department of Revenue today announced the deadline for taxpayers to file their 2020 Pennsylvania personal income tax returns and make final 2020 income tax payments is extended to May 17 2021This means taxpayers will have an additional month to file from the original deadline of April 15. PENNSYLVANIA TAX DUE DATE REFERENCE GUIDE PAGE 3 Feb. If applicable provide your local tax ID number to your payroll service provider.

2021 TAX DUE DATES NOTE. Starting January 1 2012 Jordan Tax Service will be collecting Quarterly Wage Tax WT-1 Monthly Wage Tax WTD Net Profit NP-5 Individual. Fiscal Year Oct 2020 - Sep 2021.

While the PA Department of Revenue and the IRS announced. That is Keystone will not apply late-filing penalty and interest on tax year 2020 final returns filed between April 15 2021 through May 17 2021. 4th Quarter - January 15th.

Enclose PA Schedule UE. E-Tides Tax Due Dates. To determine the due date of each installment.

FARMERS If at least two-thirds of a taxpayers gross income for 2021 will be from farming a taxpayer may do one of the following. Blair County Tax Collection. Withhold and Remit Local Income Taxes.

Taxpayers Can Use myPATH for PA Personal Income Tax Filing Prior to Filing Deadline N. Harrisburg PA With the deadline to file 2021 personal income tax returns a week away the Department of Revenue is reminding Pennsylvanians that th. And occupation tax notices to taxpayers who failed to pay by the due date.

Keep your post office receipt and ensure it. Most often quarterly filings and remittances can be made directly through the local tax collectors website. The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I Declaration of Estimated Tax coupon to the department along with their check for the estimated tax amount.

Penalty and interest that already accrued prior to April 15 2021 remains due. Quarter Oct-Nov-Dec January 31. Penalty after April 15 multiply Line 16 by 001 x number of months late.

Corporate Tax Annual. The quarterly due dates for personal income tax estimated payments are as follows. 2021 Personal Income Tax Forms.

10 December 2021 PACT Act Report Jan. We are Pennsylvanias most trusted tax administrator. CORPORATION TAXES - CORPORATE NET INCOME TAX Jan.

Read More. Or File a 2021 PA. Sales Use and Hotel Occupancy Tax Monthly.

1419 3rd Avenue PO Box 307 Duncansville PA 16635-0307. 3rd Quarter - September 15th. LOCAL EARNED INCOME TAX RETURN.

This includes taxpayers with estimated tax payments due today April 15 2021. Most state income tax returns are due on that same day. Taxpayer Signature Spouse Signature if married LAST NAME FIRST NAME MIDDLE INITIAL.

A handful of states have a later due date April 30 2022 for example. Keystone Collections Group collects current and delinquent tax revenue and fees for Pennsylvania school districts boroughs cities municipalities and townships. 28 May 31 Aug.

Taxes must be paid as taxpayers earn or receive income during the year either through withholding or estimated tax payments. Taxpayers should write 2021 Estimated Tax Payment and the last four digits of the primary. If the 15th falls on Saturday Sunday or holiday the due date would be extended to the next business day.

Income tax returns must be postmarked on or before the 2022 filing due date to avoid penalties and late fees. Who appear on the tax rolls but did not file a 2020 Final Local Earned Income Tax.

Prepare And Efile Your 2021 2022 Pennsylvania Tax Return

Pennsylvania Department Of Revenue Facebook

Update To Montogmery County Common Level Ratio The Pennsylvania Department Of Revenue The Pennsylvania Department Of Revenu Veterans Id Card County State Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

Pennsylvania Tax And Labor Law Guide In 2021 Labor Law Workers Compensation Insurance Employee Health

Pennsylvania Department Of Revenue Facebook

Pennsylvania Department Of Revenue Facebook

Certified Valuation Analyst In 2021 Cpa Accounting Accounting Firms Income Tax Preparation

20 Microsoft Office Invoice Templates Free Download Pertaining To Microsoft Office Word Invoice Template C Microsoft Office Word Office Word Invoice Template

Pennsylvania Department Of Revenue Facebook

Social Security Number Verification Letter In 2021 Lettering Letter Example Social Security Office

2012 Eagle Ford Shale Story Oil And Gas Shale Gas Shale

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Property Tax H R Block